Brendan Wales, Principal e.ventures Brendan joined e.ventures in March of 2012 and specializes in investing in online marketplaces, fin-tech, developer tools and open source software. He has worked on e.ventures’ investments in Shipt, CodeFights, AppDiff, StackShare, Segment, App Annie, Acorns, When I Work, Shutl (Acquired by ebay), Everything But The House, Spothero, Nativo and HireAthena and is also actively involved with existing investments NGINX, Upsight, and Housecall. As a part of the e.ventures’ team that leverages big data for deal origination, Brendan has been closely involved in the firm’s development and utilization of in-house technology built to discover growing internet enabled companies. Prior to joining e.ventures, Brendan was an early employee at 500 Startups backed ZOZI, a leading SAAS booking platform for Tour and Activity Providers. He started his career at Sun Life Financial, a Fortune 500 financial services company, and has also started two consumer internet start-ups. Brendan earned a B.A. in Finance from the University of Georgia.

Interviews

Sumeet Ajmani, General Counsel Nova Credit Inc #fintechcredit

Sumeet Ajmani, General Counsel Nova Credit Inc Nova Credit is the world’s premier cross-border credit bureau, where Sumeet leads Nova Credit’s US and international legal, regulatory and compliance efforts. Prior to joining, Sumeet led the Legal and Compliance functions at Credit Karma, helping advise as the company provided consumer’s access to free credit scores and reports, educational information and targeted financial products. He also served as an attorney at the Board of Governors for the Federal Reserve System from 2010-2014, providing a broad range of legal counseling on matters in the areas of data management, compliance with federal information security standards and banking regulation. Before pursuing his legal career, Sumeet worked as an Analytic Consultant at FICO, leading analytical design and development efforts on credit and insurance risk scoring models. Sumeet obtained his J.D. from Berkeley School of Law and a B.S. in Management Science & Engineering from Stanford University.

Jonathan Gole, Senior Director Business Analytics and Product Management Capital One #fintechcredit

Jonathan Gole, Senior Director Business Analytics & Product Management Capital One Jon works in Capital One’s credit card business, leading agile development efforts with software engineers, data scientists, and data analysts. His teams are focused on transforming Capital One’s operational underwriting systems, introducing new big and fast data analytics capabilities in the cloud, and developing ML-based prediction systems to protect our customers and shareholders. Jon has worked at Capital One for over seven years in a variety of roles focused on managing credit risk and improving customer experiences.

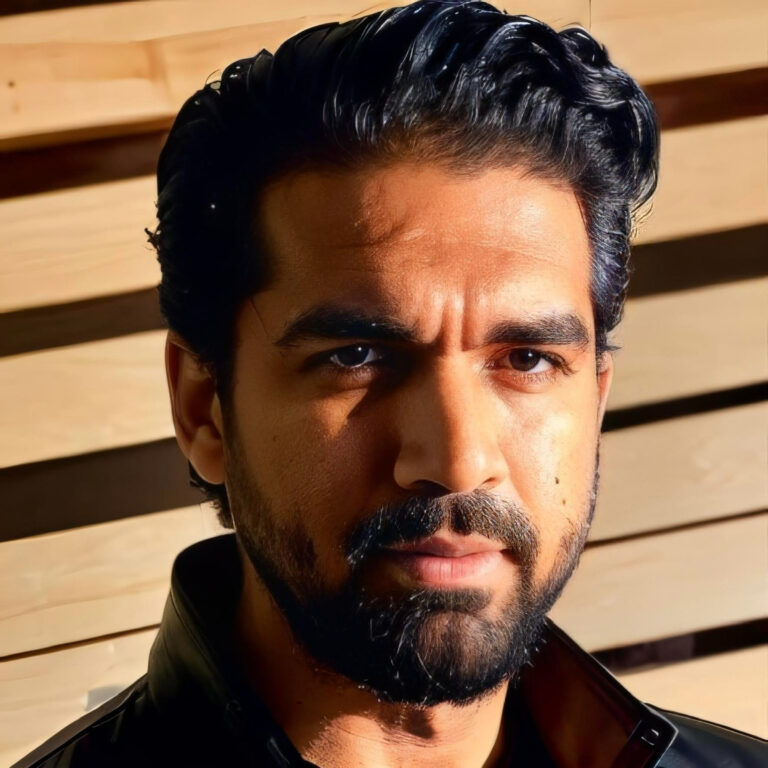

Brad Pennington , CRO Prosper Marketplace #fintechcredit

Brad Pennington , CRO Prosper Marketplace. In this role, he is responsible for overseeing all of the elements of the loan product, including pricing, underwriting strategy, credit policy, verification strategy, loss-forecasting, model development, model governance and new risk product development. Brad joined Prosper in 2012 and was instrumental to the development of Prosper’s rating systems, automated strategies and cutting edge monitoring systems. He has held roles with an increasingly broad set of responsibilities during his tenure with Prosper and he brings more than 10 years of experience in risk management and applied analysis. Prior to joining Prosper, Brad was a Credit Risk consultant with Moody’s Analytics where he worked with large global and U.S. clients focusing on Economic Capital, Basel Compliance and PD, LGD and EAD model development. He began his risk career designing the automated underwriting and pricing strategies at First Equity Card; a small-business credit card specialty finance start-up. Brad obtained his B.S in Economics from the Wharton Undergraduate School where he completed a self-directed course of study, obtaining minors in Finance, Statistics, Mathematics, Econometrics and Operations Research.