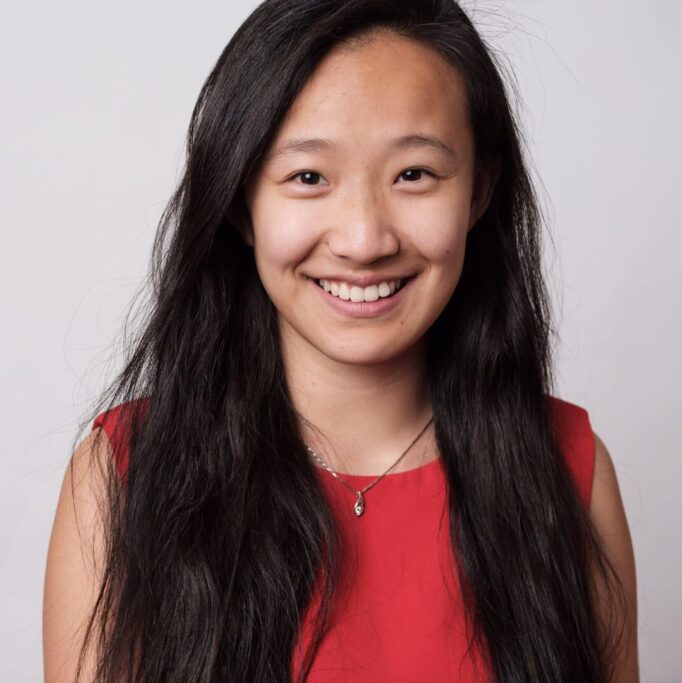

Shuo Chen is a General Partner at IOVC, where she focuses on early stage venture investments in Silicon Valley with a focus on future of work and enterprise/SaaS. She is also Faculty at UC Berkeley and Singularity University. Shuo is appointed by California Governor Gavin Newson to serve as 1 of 13 voting members on California’s Mental Health Commission (as the first Asian American Commissioner), which includes overseeing ~$2.6 billion annually in state budget and advising the Governor or the Legislature on mental health policy.In her venture role, Shuo has invested in companies now acquired by Goldman Sachs, Ford, Caterpillar, Binance and Dialpad, as well as now unicorns including Boom, Checkr, Grubmarket, Instacart and Rescale. She has helped portfolio companies close deals with Amazon, Apple, Google, Mercedes-Benz and NASA among others, as well as scaled portfolio companies into Europe and Asia.Prior, Shuo worked at Goldman Sachs in investment banking, where she worked with clients including Alibaba and Tencent, as well as represented the firm on the Board of Women in Finance. Before that, Shuo was at PwC, where she worked on Google’s $12.5 billion acquisition of Motorola and LinkedIn’s $119 million acquisition of SlideShare. Shuo has also co-authored one of the leading books on financial regulations published by Cambridge University Press in 2019, and sits on the Advisory Board of Forbes China, where she advises on content and awards for Asian Americans in North America.

covid19

Marvin Liao, Global Macro Startup Investor

Marvin Liao is an Investor-Operator, executive coach and formal advisor to several large Family Offices. Marvin is a Partner at Rolling Fund Diaspora.vc, Manages the Angel Fund Sukna Global & a Board member at Game Groove Capital, an International Gaming Holding Company. He was previously a Partner at Venture Capital Fund 500 Startups, running the SF based accelerator program as well as investing in Seed stage start ups. He has invested in over 414 Pre-seed & Seed stage startups during the 6 years spent there. Marvin also spent 10.5 years at Yahoo! as an executive with extensive operating experience expanding businesses across Asia, Europe, Latin America and the United States in his career at the company. Marvin presently serves on the Investment Committees/Advisory boards of several Venture Capital funds. He also mentors at numerous accelerator programs around the world.

Ramneek Gupta, Founder/Managing Partner PruVen Capital

Ramneek is the Founder and Managing Partner of PruVen Capital, an independent, returns driven firm created in partnership with Prudential Financial as the single limited partner. Our first fund is a $300M multi stage investment vehicle designed to focus on verticals including Insurance, Financial Services, Healthcare IT/Tech/Data, Real estate/Proptech, Asset/Wealth Management and Enterprise IT. Prior to founding PruVen, Ramneek was the Co-founder of the venture investing efforts at Citi. At Citi Ventures, he led investments in over 25 companies across fintech & digital commerce space that represent over $180B in market value. Some of his notable investments included Square (NYSE: SQ), Jet.com (Acq by Walmart for $3.3B), DocuSign (NASDAQ: DOCU), Honey (Acq by Paypal for $4B), Grab (NYSE: GRAB), Datarobot, Feedzai, Homelight & Zum. Prior to Citi Ventures, Ramneek was a partner at Battery Ventures, where he led the build out of their investment practice in India and before that he held various product development roles at PMC Sierra and TiVo. He is also an angel investor and has had the opportunity to partner with founders thru early investments in companies like Robinhood (NASDAQ: Hood), CheckR, Ipsy, Vicarious, Maxxa and Gridspace. Ramneek received a BS in Mechanical Engineering from the Indian Institute of Technology (IIT) Bombay, where he graduated at the top of his class and an MS in Mechanical Engineering from Stanford University.

SC Moatti Founding Managing Partner Mighty Capital

SC Moatti is the Founding Managing Partner of Mighty Capital; the Founding CEO of Products That Count, the most influential product acceleration platform; and a lecturer at Stanford and Columbia Universities. Prior, SC built products that billions of people use at Facebook and Nokia. Andrew Chen, General Partner at Andreessen Horowitz, called SC “a genius at making products people love.” SC serves on the boards of public and private companies, earned a master’s in electrical engineering, a Stanford MBA, and is a Kauffman Fellow. For more information, visit Mighty.Capital. Mighty Capital is an early-growth Silicon Valley venture capital (VC) firm. We deliver exceptional returns by investing in great products that are also great businesses, like Airbnb, MissionBio and Amplitude. Founders and other VC firms invite us to invest because we help our portfolio companies sell faster, hire top talent, and generate liquidity, by giving them exclusive access to the original and most influential product acceleration platform, Products That Count. Amplitude calls us the “best value for the dollar invested.”