Minnie Ingersoll is a partner at TenOneTen and host of the LA Venture podcast. TenOneTen is a venture fund based in LA investing in early stage software and data companies. Prior to TenOneTen, Minnie was the COO and co-founder of recently public Shift Technologies (Nasdaq : SFT), an online marketplace for used cars. In her spare time, Minnie surfs baby waves and raises baby people.

Silicon Valley

Stephen Bulfer, CEO/CoFounder StreamLoan

Stephen has immersed himself in mortgage lending since 2015 with StreamLoan, a pioneer in digital mortgage, streamlining the mortgage process with digital technology for his mortgage lending customers, specifically dedicated to redefining the lead management and mortgage origination experience. Beyond thought leadership, he is a subject matter expert across the residential real estate & real estate finance category, including real estate experience covering both residential investment (20 years experience) and research; Stephen’s concentration during his MBA was real estate finance, with special focus on the subprime mortgage crisis. As a technical CEO, he has a unique background, blending of both startup and enterprise software. His extensive software start-up experience includes building five startups, most recently with the 2013 ionGrid acquisition by NetApp. Stephen has significant experience across strategy, build, and deployment of enterprise software at Fortune 500 companies extending to White House & Executive Office of the President, HP, Visa, MasterCard, Allstate, Kaiser, P&G, and over 50 Fortune 500 organizations. StreamLoan is an award winning mobile and SaaS platform. StreamLoan is a Silicon Valley based venture backed software firm (with HQ in San Francisco). Stephen holds two master’s degrees from Columbia Business School and University of California Berkeley. His passions cover skiing & snowboarding, travel, music, among other life adventures.

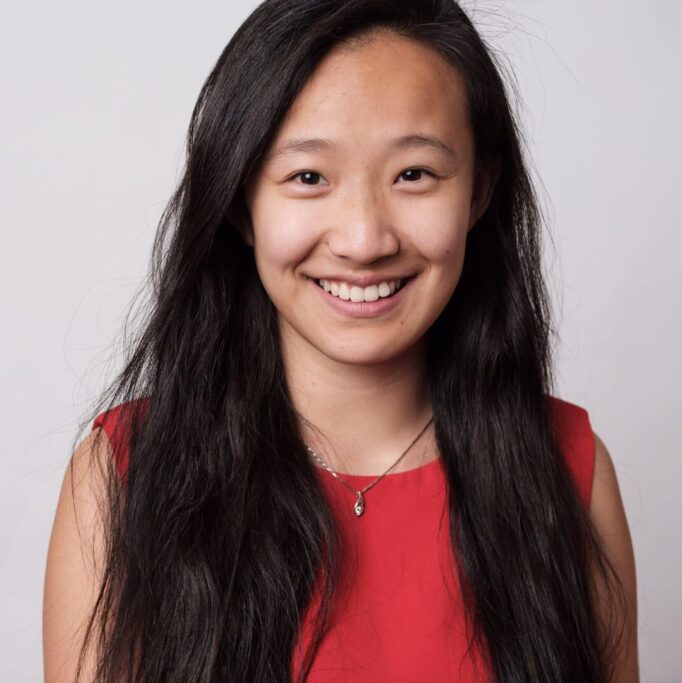

Shuo Chen, General Partner IOVC

Shuo Chen is a General Partner at IOVC, where she focuses on early stage venture investments in Silicon Valley with a focus on future of work and enterprise/SaaS. She is also Faculty at UC Berkeley and Singularity University. Shuo is appointed by California Governor Gavin Newson to serve as 1 of 13 voting members on California’s Mental Health Commission (as the first Asian American Commissioner), which includes overseeing ~$2.6 billion annually in state budget and advising the Governor or the Legislature on mental health policy.In her venture role, Shuo has invested in companies now acquired by Goldman Sachs, Ford, Caterpillar, Binance and Dialpad, as well as now unicorns including Boom, Checkr, Grubmarket, Instacart and Rescale. She has helped portfolio companies close deals with Amazon, Apple, Google, Mercedes-Benz and NASA among others, as well as scaled portfolio companies into Europe and Asia.Prior, Shuo worked at Goldman Sachs in investment banking, where she worked with clients including Alibaba and Tencent, as well as represented the firm on the Board of Women in Finance. Before that, Shuo was at PwC, where she worked on Google’s $12.5 billion acquisition of Motorola and LinkedIn’s $119 million acquisition of SlideShare. Shuo has also co-authored one of the leading books on financial regulations published by Cambridge University Press in 2019, and sits on the Advisory Board of Forbes China, where she advises on content and awards for Asian Americans in North America.

Marvin Liao, Global Macro Startup Investor

Marvin Liao is an Investor-Operator, executive coach and formal advisor to several large Family Offices. Marvin is a Partner at Rolling Fund Diaspora.vc, Manages the Angel Fund Sukna Global & a Board member at Game Groove Capital, an International Gaming Holding Company. He was previously a Partner at Venture Capital Fund 500 Startups, running the SF based accelerator program as well as investing in Seed stage start ups. He has invested in over 414 Pre-seed & Seed stage startups during the 6 years spent there. Marvin also spent 10.5 years at Yahoo! as an executive with extensive operating experience expanding businesses across Asia, Europe, Latin America and the United States in his career at the company. Marvin presently serves on the Investment Committees/Advisory boards of several Venture Capital funds. He also mentors at numerous accelerator programs around the world.